· 5 min read

Never Miss a Risk Factor Again: Avoiding Common Underwriting Mistakes with AI

Learn how insurance agents are using AI to catch hidden risk factors, improve accuracy, and write better business while spending less time on each submission.

Have you ever had that sinking feeling? You know the one – when a claim comes in, and suddenly you spot a risk factor that was missed during underwriting. Maybe it was a note buried deep in the inspection report, or a detail mentioned in passing on page 47 of the appraisal. In today’s fast-paced insurance market, these oversights aren’t just stressful – they can be costly for both you and your clients.

“I thought I was thorough in my reviews,” shares Jennifer Martinez, a veteran insurance agent with 15 years of experience. “But when you’re processing dozens of submissions a week, it’s almost impossible to catch every detail manually. I learned this the hard way when a missed foundation issue led to a significant claim that could have been prevented.”

Jennifer’s experience isn’t unique. In fact, studies show that up to 40% of property insurance submissions contain incomplete or inaccurate information. But here’s the good news: AI is changing this reality for insurance professionals.

Why Even Experienced Agents Miss Important Details

Think about your typical day. You’re juggling multiple submissions, each with its own stack of documents – inspection reports, appraisals, loss runs, and more. You’re also:

- Racing against quote deadlines

- Responding to urgent client questions

- Managing carrier requirements

- Coordinating with real estate agents

- Handling policy renewals

With all these competing priorities, it’s no wonder important details sometimes slip through the cracks. The traditional “checklist” approach to underwriting simply can’t keep up with the complexity of modern risks.

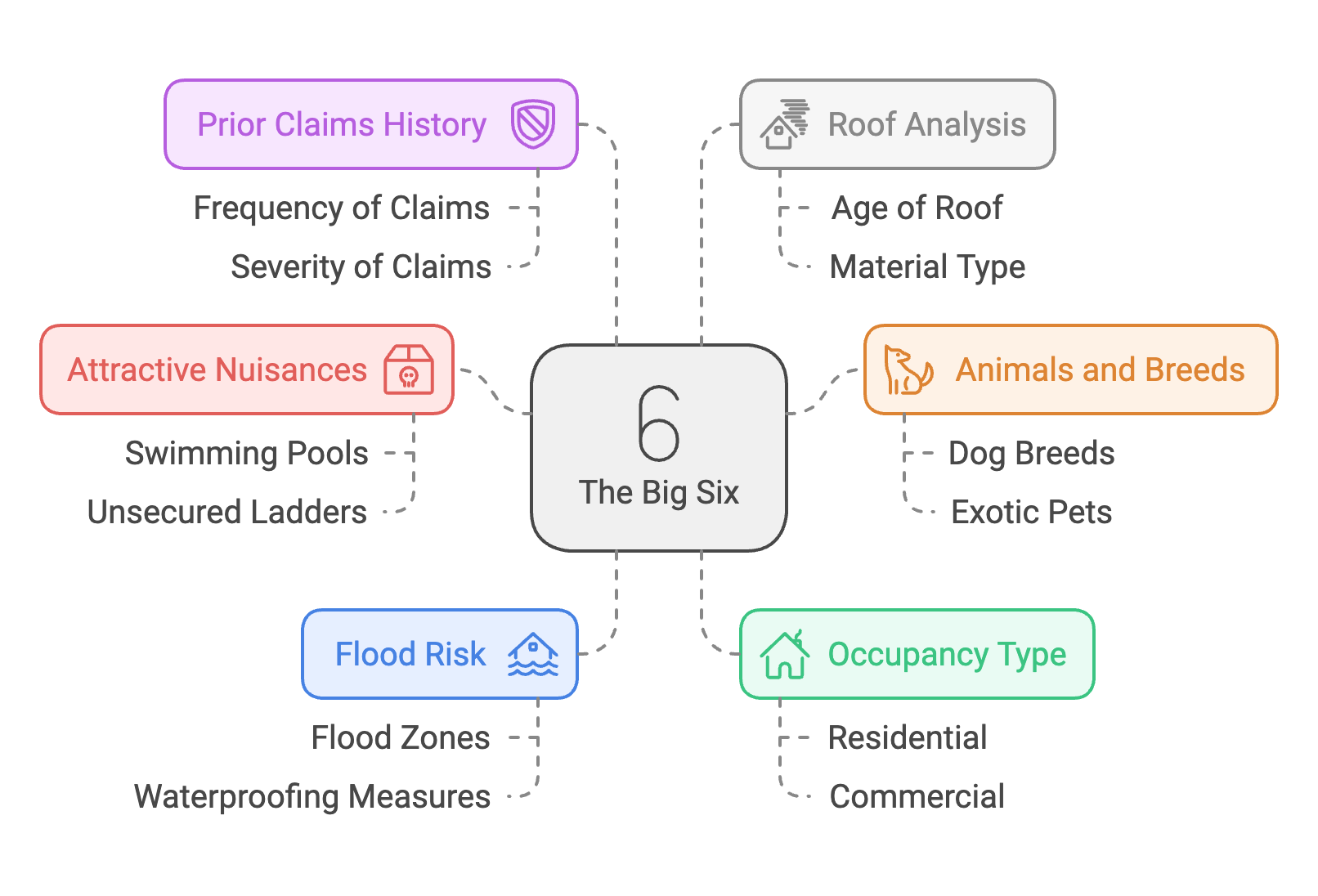

The Most Common Oversights in Property Underwriting

Mark Thompson, an underwriting manager at a regional carrier, shares the top issues he sees:

“The most frequent oversights aren’t usually obvious red flags. They’re the subtle details that paint a complete risk picture – things like inconsistencies between the appraisal and inspection report, or maintenance issues that suggest larger underlying problems.”

Some examples include:

- Historical repairs mentioned in different documents

- Conflicting information about property features

- Subtle indicators of future maintenance issues

- Missing or outdated safety features

- Neighborhood risk factors not mentioned in primary documents

How AI Catches What Humans Miss

This is where AI technology becomes a game-changer. Unlike humans, who can get fatigued or distracted, AI maintains consistent attention to detail across every page of every document. Here’s how it works:

Complete Document Analysis

When Sarah Lee, an independent agent in Florida, uploads documents to her AI underwriting platform, something remarkable happens: “The system doesn’t just scan for keywords – it actually understands context. It recently flagged a potential flood risk by connecting information from three different documents that I might never have correlated manually.”

Pattern Recognition

AI excels at spotting patterns that might not be obvious to the human eye. For instance, it can identify:

- Maintenance patterns that suggest future issues

- Inconsistencies across multiple documents

- Risk combinations that warrant closer attention

Automated Cross-Referencing

“What impressed me most,” says David Chen, another agent using AI underwriting, “was when the system flagged a discrepancy between the square footage listed in the tax records and the recent appraisal. It was a detail I might have missed, but it turned out to be crucial for accurate coverage calculations.”

Real Success Stories

Let’s look at how agents are using AI to improve their underwriting accuracy:

Maria Rodriguez used to spend hours cross-referencing documents for each submission. “Now,” she says, “the AI does this automatically, and it recently caught a crucial detail about an outdated electrical system that was mentioned only briefly in an old inspection report. This saved us from what could have been a serious fire risk.”

Tom Baker had a similar experience: “Last month, the AI flagged a pattern of minor water damage repairs that suggested a larger plumbing issue. We were able to require updated plumbing before binding the policy, potentially preventing a major claim.”

Practical Tips for More Accurate Underwriting

Here’s how you can start improving your underwriting accuracy today:

-

Think Beyond the Checklist Instead of relying solely on standard forms, use AI to analyze the complete narrative of each property. Let technology handle the heavy lifting of document analysis while you focus on strategic decision-making.

-

Embrace Technology as Your Partner Remember, AI isn’t replacing your expertise – it’s enhancing it. Use it to verify your instincts and catch details you might miss during busy periods.

-

Learn from Each Submission Modern AI systems learn from every submission they process, continuously improving their ability to identify potential issues. Make this technology part of your regular workflow to build a stronger, more accurate underwriting process.

The Future of Accurate Underwriting

As Jennifer Martinez reflects, “Looking back, I wish I’d had this technology years ago. Not only would it have prevented some difficult situations, but it would have given me more confidence in my underwriting decisions.”

The reality is that property risks are becoming more complex, not less. Climate change, evolving building technologies, and changing regulations mean there are more factors to consider than ever before. Trying to manage this complexity manually isn’t just inefficient – it’s becoming impossible.

Take Your First Step Toward Better Underwriting

Are you ready to reduce oversights and write better business? Here’s a practical next step: Schedule a demo to see how AI can help you catch the details that matter in your specific market. We’ll show you exactly how the technology works with your actual submission documents.

Don’t wait for a claim to reveal what you might have missed. Join the growing number of insurance professionals who are using AI to write better business, more confidently.