· 4 min read

Getting the Most Out of Sparrowshield: A Guide for Insurance Agents

Learn how to leverage Sparrowshield's AI capabilities to transform your insurance business, from streamlining workflows to closing more deals.

“I wish someone had shown me this sooner,” remarked Mike Davidson, a veteran insurance agent with 15 years of experience. “I spent years perfecting my workflow, but within a week of using Sparrowshield, I was writing twice the business in half the time.”

Mike’s story isn’t unique. Many experienced agents find themselves stuck in traditional workflows, not because they resist change, but because they haven’t seen a better way. Today, I want to share how you can transform your insurance business using Sparrowshield, just like Mike did.

Start With What You Know

The beauty of Sparrowshield is that it works with your existing process, not against it. Remember that stack of inspection reports on your desk? Or those endless property photos clients email you? Instead of manually typing that information into carrier portals, simply upload them to Sparrowshield.

“At first, I was skeptical about letting AI handle my documents,” says Jennifer Martinez, an independent agent in Texas. “But when I saw how accurately it pulled information from a 60-page inspection report in seconds, I was sold. Now I just drag and drop documents, and Sparrowshield does the rest.”

Let AI Do the Heavy Lifting

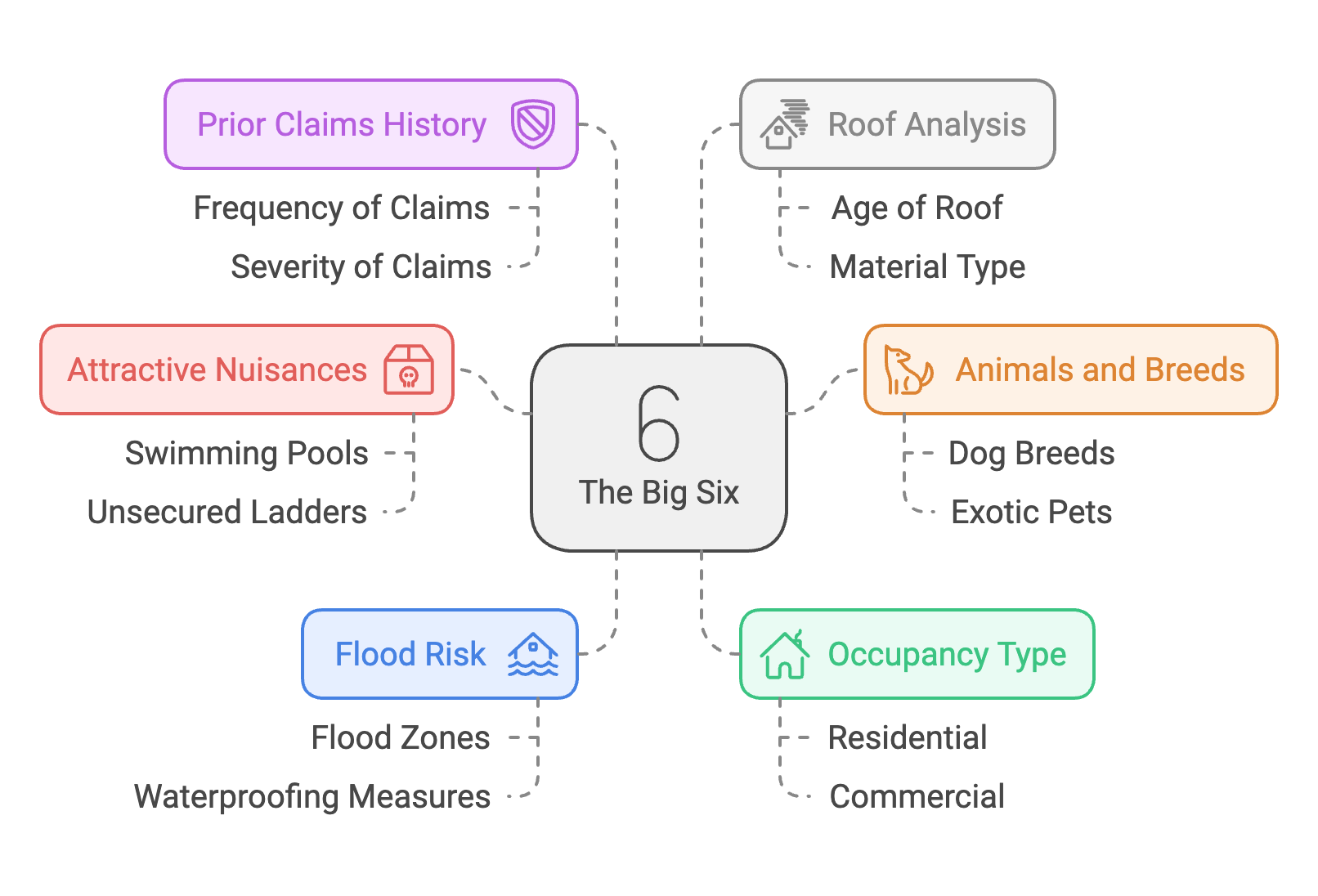

Think about your typical property submission process. You probably spend hours gathering data from various sources, cross-referencing information, and checking carrier guidelines. With Sparrowshield, this process transforms entirely.

When Lisa Chen, a growing agency owner, first started using Sparrowshield, she discovered something interesting: “The AI doesn’t just collect data – it thinks like an underwriter. It flags potential issues I might have missed and suggests solutions before I even submit to carriers. That’s been a game-changer for my approval rates.”

Maximize Your Multi-Carrier Advantage

As an independent agent, your strength lies in offering clients multiple options. But managing different carrier requirements can be overwhelming. Here’s where Sparrowshield truly shines.

“Last week, I had a complex property that would typically take days to shop around,” shares Tom Williams, an agent in Florida. “With Sparrowshield, I entered the information once, and within minutes, I knew exactly which carriers would be most likely to approve it. The client was amazed when I came back with multiple quotes so quickly.”

Turn Data Into Insights

Sparrowshield isn’t just about processing data faster – it’s about making you a better agent. The system learns from every submission, helping you spot trends and opportunities you might otherwise miss.

Rachel Foster, who specializes in high-value properties, notes: “The insights I get from Sparrowshield have changed how I approach my market. I can see patterns in which properties get approved where, making me much more strategic in how I submit applications.”

Build Stronger Client Relationships

When you spend less time on paperwork, you can focus more on what really matters – your clients. Mark Thompson discovered this shortly after implementing Sparrowshield: “I used to spend 80% of my time on administrative tasks. Now that ratio has flipped. I’m having more meaningful conversations with clients, understanding their needs better, and providing more value.”

Growing Your Business with Confidence

The most rewarding feedback we hear from agents is how Sparrowshield helps them grow their business with confidence. Sarah Miller, who doubled her agency’s size last year, puts it perfectly: “Knowing that I have AI backing up my decisions gives me the confidence to take on more complex cases. I’m not just writing more business – I’m writing better business.”

Your Path to Success

Every agent’s journey with Sparrowshield is unique, but the destination is the same: a more efficient, profitable, and satisfying insurance business. Whether you’re looking to save time, write more business, or simply reduce the stress of underwriting, Sparrowshield adapts to your needs.

Ready to transform your insurance business? Start your journey with Sparrowshield today, and join the growing community of agents who are redefining what’s possible in insurance.