· John Smith · Insurance Technology · 2 min read

Get Started with SparrowShield - Revolutionizing Insurance Underwriting with AI

Discover how SparrowShield leverages AI to transform the insurance underwriting process. Explore our guide to streamline your operations and enhance accuracy.

In the rapidly evolving world of insurance, staying ahead of the curve is crucial. SparrowShield is leading the charge by revolutionizing the underwriting process with its state-of-the-art AI technology. Designed to streamline operations and enhance accuracy, SparrowShield is transforming how insurance professionals approach underwriting.

Transforming Underwriting with AI

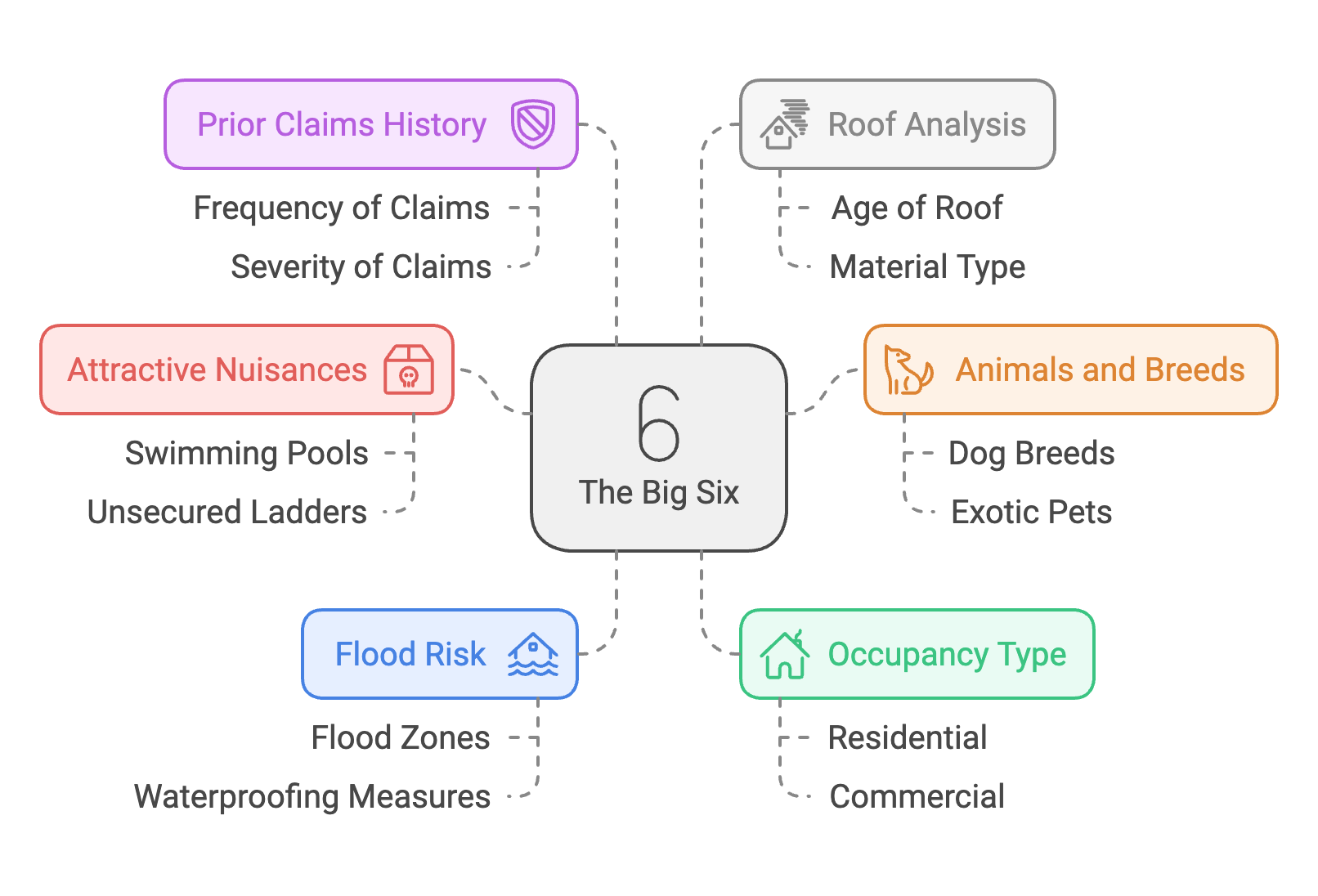

At the heart of SparrowShield is its powerful AI-driven risk assessment tool. By leveraging advanced algorithms, SparrowShield extracts critical data from documents and analyzes risk factors with unprecedented precision. This not only improves the accuracy of underwriting but also significantly reduces the time required to process applications, allowing insurers to deliver faster, more accurate quotes.

Key Features of SparrowShield

SparrowShield offers a suite of features designed to enhance every aspect of the underwriting process. Its AI-powered risk assessment provides a comprehensive analysis that helps insurers make informed decisions. The platform’s automated data collection seamlessly integrates information from sources like Zillow and Trello, automating property detail inputs and reducing manual errors.

Integration is effortless with SparrowShield, as it connects easily with existing CRM and insurtech platforms such as Agency Zoom and EZLynx. This ensures that insurers can continue using their preferred tools while benefiting from SparrowShield’s advanced capabilities.

Moreover, SparrowShield’s real-time geographic qualification assesses risk based on various factors, including location, heating type, and construction age. The platform also features optical character recognition (OCR) to automate document processing, further enhancing efficiency.

Why Choose SparrowShield?

Efficiency and accuracy are at the core of SparrowShield’s offerings. By automating processes, SparrowShield reduces underwriting time by up to 50%, allowing insurers to focus on what truly matters—serving their clients. The platform’s AI insights increase quote accuracy, providing a competitive edge in the market.

Security is paramount, and SparrowShield is built with robust security measures to protect sensitive data. Its scalable architecture ensures that it can grow alongside your business, adapting to your evolving needs.

Get Started with SparrowShield

Join the growing number of insurance professionals who trust SparrowShield to revolutionize their underwriting process. Whether you’re an independent agent or part of a large firm, SparrowShield offers the tools you need to succeed in today’s competitive landscape.

To learn more about how SparrowShield can benefit your business, visit our website or contact our sales team to schedule a demo. Experience the future of insurance underwriting with SparrowShield.

This blog format provides a narrative that highlights SparrowShield’s features and benefits, offering a compelling story for potential users. Make sure to update the links and images with actual resources from SparrowShield.