· 3 min read

How AI is Transforming the Way Insurance Agents Write Business

Discover how independent agents are using AI to streamline their underwriting process and write more business, while spending less time on paperwork.

It’s 4:45 PM on a Friday, and you’ve just received an urgent email from a client needing a quote for their dream home. The inspection report is 50 pages long, and you know you’ll need to check eligibility with multiple carriers. Sound familiar?

As an independent insurance agent, you’ve probably lost count of how many evenings you’ve spent manually entering property data, cross-referencing carrier guidelines, and waiting for underwriting decisions. In today’s fast-paced market, this traditional approach isn’t just frustrating—it’s holding your agency back from growth.

The Real Cost of Manual Underwriting

Think about your typical day. How much time do you spend typing the same information into different carrier portals? Or worse, how many deals have you lost because you couldn’t get back to a client quickly enough with a quote? The traditional underwriting process isn’t just time-consuming; it’s costing you valuable business opportunities.

Sarah Thompson, an independent agent in Denver, knows this struggle all too well. “I used to spend my evenings catching up on data entry,” she says. “Every minute spent copying and pasting data was a minute I couldn’t spend growing my business or helping my clients.”

A New Way Forward

The insurance industry is changing, and AI is leading that change. But this isn’t about replacing human expertise—it’s about enhancing it. Modern AI technology can now handle the tedious parts of underwriting, letting you focus on what you do best: building relationships and growing your business.

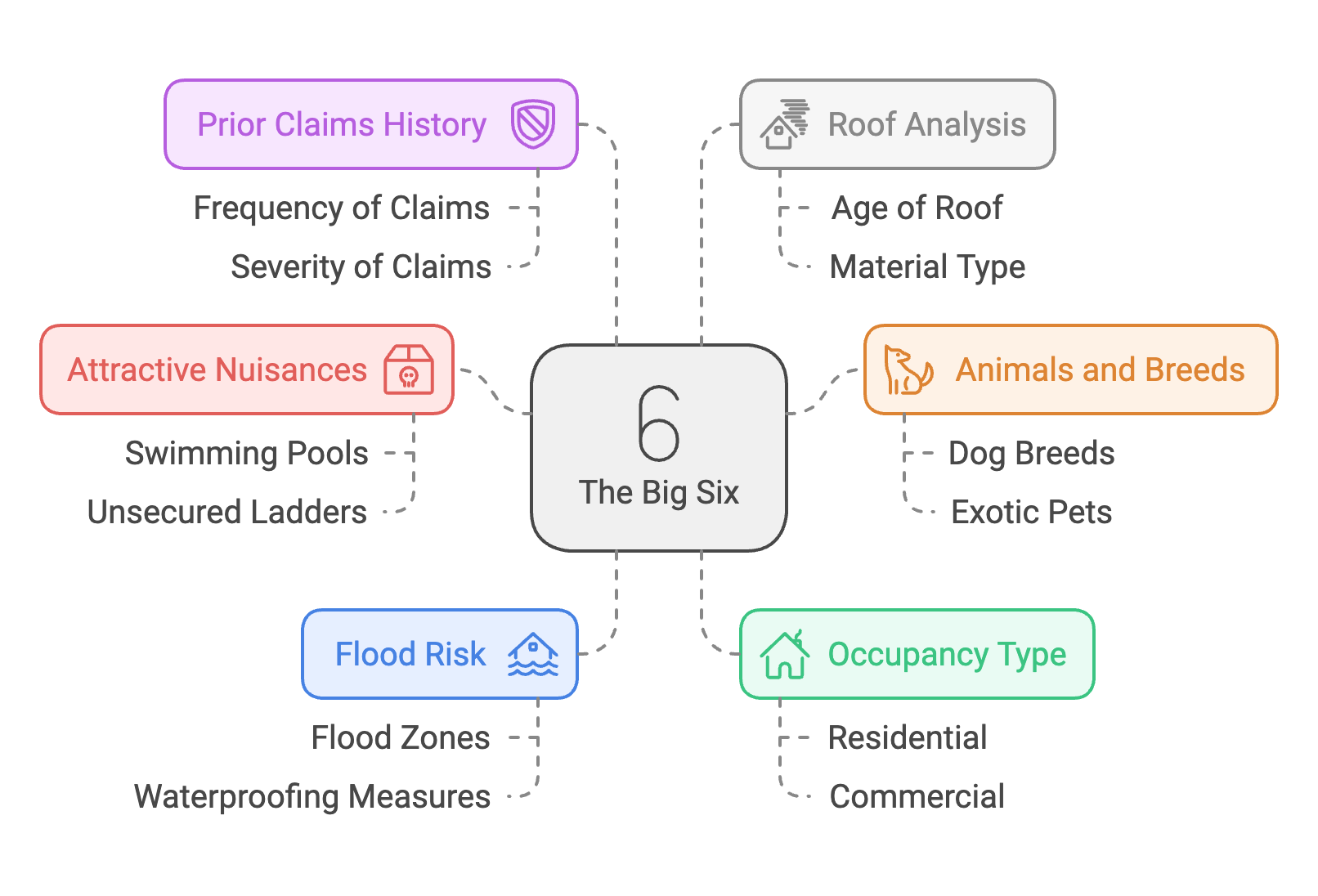

When a new property comes across your desk, imagine having all the relevant data—from property details to risk factors—automatically extracted and analyzed. No more manual data entry, no more switching between multiple websites and documents. The technology reads and processes everything from inspection reports to property records, giving you a complete picture in seconds.

Real Stories, Real Results

Let’s go back to Sarah’s story. After implementing AI-powered underwriting tools, her workflow transformed dramatically. “Now when I get a new property to quote, the system automatically pulls data from Zillow, Google Maps, and other sources. What used to take hours now takes minutes,” she explains.

But the benefits go beyond just saving time. Sarah found herself able to write more business because she could respond to clients faster and more accurately. “Last month, I got a call at 4 PM about a high-value property. By 4:30, I had quotes from three different carriers ready to go. The client was amazed at how quickly we could move.”

The Future is Already Here

The insurance industry is evolving rapidly, and those who adapt will thrive. Modern AI tools aren’t just about speed—they’re about giving you the freedom to focus on growing your business. Imagine spending your days building client relationships instead of copying and pasting data. Picture having the confidence to know that when a client calls, you can give them answers in minutes, not days.

For independent agents like you, this technology means: More time for client relationships Faster, more accurate quotes The ability to write more business Confidence in your risk assessments

Your Next Step

The question isn’t whether to embrace AI in your underwriting process—it’s when. Every day you spend with manual processes is a day you could be growing your business instead. The technology exists now to transform your workflow, delight your clients, and help you write more business than ever before.

Ready to see how AI can transform your underwriting process? Take the first step toward modernizing your agency today.